Analysis: How social networks eliminated Silicon Valley Bank News Desk · 1 month ago · 6 minutes checked out

Analysis: How social networks eliminated Silicon Valley Bank News Desk · 1 month ago · 6 minutes checked out

Social network has actually permanently altered how we see and handle monetary crises. Banks require a method to tactfully manage what is now being created “social networks danger.”

6 minutes checked out

Upgraded: March 27, 2023 at 6:01 pm

Cover art/illustration through CryptoSlate

The following is a visitor post by web3 strategist Toby Fan, and Aly Madhavji, Managing Partner at Blockchain Founders Fund.

Social network has actually permanently altered how we see and handle monetary crises. Banks require a method to tactfully manage what is now being created “social networks threat.” Viral video games of the telephone dipped into a rapid scale enable extremely little time for nuanced examination or thoughtful response. By including social networks into total threat structures, banks can assist form the story and public understanding through pre-emptive and transparent client engagement. Aggregation and tracking tools are ending up being significantly essential to keep an eye on for early indications of problem and browse this landscape of quick details consumption and uncontainable spread.

Current collapses of a few of the biggest crypto-associated banks ($SIVB, $SI, $SBNY) have actually sent out jitters through tech, crypto, and banking sectors. Lots of start-ups were left questioning whether they might satisfy payroll commitments, while local banks captured whiffs of a bank run for the very first time given that the subprime home loan crisis.

Crowd-sourced analyses of info concerning $SIVB’s monetary health provided depositors a refresher course (no pun meant) in Game Theory 101– putting numerous start-ups and tech business in the shoes of a detainee on a book reward matrix: withdraw deposits now or run the risk of holding the bag.

How It All Went Wrong

On Mar 8, Moody’s reduced $SIVB bank deposit and provider rankings. On the very same day, $SIVB revealed a proposed sale of $2.25 bn in stock, in addition to a balance sheet rearranging revealing a $1.8 bn recognized loss from offering fixed-income properties that had actually lost substantial market price with the current walking in Fed rates.

Like lots of bank runs prior to this one, depositors, much of them VC-funded and crypto business, lost no time at all playing a video game of chicken. Within a day or 2, $SIVB balance sheets were drying up and the stock was, toppling– by Mar 10, regulators had actually closed $SIVB and taken control of its deposits. A variety of local banks did the same, taking huge drawdowns in market price ($FRC, $WAL, $CMA, $ZION) prior to recuperating on the news of an FDIC backstop in deposit insurance coverage. And while there have actually been comparable circumstances of bank runs in monetary history, what made this one so extraordinary was the speed at which it occurred and the medium through which the contagion spread.

Financial contagion went viral over social networks. Social network platforms like Twitter control the crypto and start-up area. The speed of info spread (in addition to various analyses) is an order of magnitude greater than conventional news or direct media. Even regulators have actually acknowledged the effect of social networks on the most current crisis. Home Financial Services Committee chairman Patrick Henry confessed “this was the very first Twitter sustained bank run”.

Some might keep in mind Washington Mutual, which experienced comparable deposit outflows throughout the 2007-2008 monetary crisis. Like $SIVB, WaMu held over $188bn in deposits however started to make a note of considerable losses due to defaulted home mortgages. When Lehman Brothers collapsed on Sept 15, 2008, WaMu depositors started withdrawing in droves– getting $16.7 bn from examining and cost savings accounts (~ 11% of overall deposits) over 10 days. The speed of the outflows was unmatched at the time, eventually causing WaMu’s personal bankruptcy. Contrast this with $SIVB– where depositors tried to withdraw $42bn in a single day, comparable to 25% of overall deposits.

This time around, it wasn’t simply the speed of info that was extraordinary however the distance of social range (in between Twitter fans, pals, and subreddits) that assisted the news spread like wildfire. Whereas previously in standard media, news was spread out from central celebrations to the masses (a one-to-many deal)– social networks is a many-to-many deal, and the social range in between sources is much more detailed, providing these possessions a level of social evidence that hasn’t constantly existed in standard media. And as soon as the details reaches emergency, it ends up being reality as the inertia of the spread triggers the story to end up being common. As they state, an individual’s understanding is their truth.

The Power Of Viral Narratives

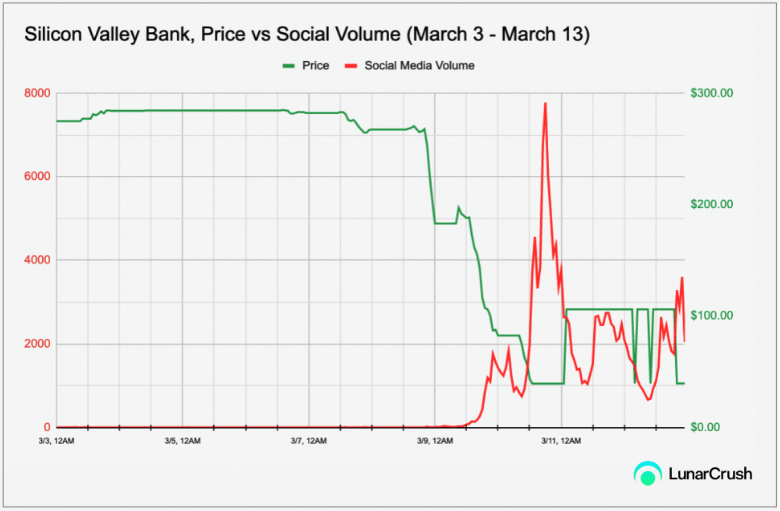

By keeping track of aggregate social networks information, you can see examples of this fast spread, even early signals of it. Take, for example, Silicon Valley Bank:

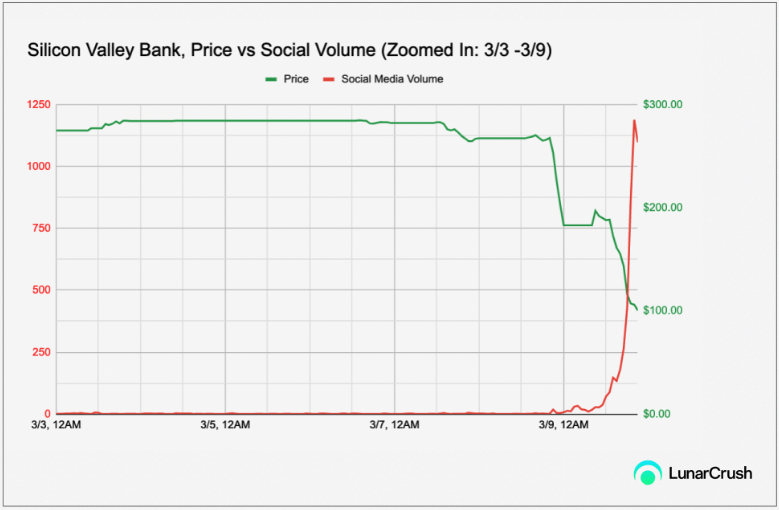

In red, we have social networks volume (private tweets/posts/news short articles throughout Twitter, Reddit, and 1000+ news sources) and the $SIVB stock cost in green. You can see an after-the-fact spike in social networks volume. Zooming in even more, you can begin to see development in chatter prior to the parabolic spike in social media volume (signifying the effective speed of social media reach):

Focusing even further into the days leading up to $SIVB’s substantial drawdown, you can see the whispers of market experts and experts prior to a big relative spike right when the stock starts to drop. By doing a bit of extra examining around the time the social networks activity began to get, an expert might have had the ability to obtain surprise gems like this by Matt Harney:

Lower fundraising

+

Capital unfavorable services (usually)

=

Liquidity draining pipes:

unfavorable $57b in Total Client Funds in 2022 from start-ups banking at Silicon Valley Bank

— source = newest MS “Venture Vision” pic.twitter.com/ZMD7miBuyE

— Matt Harney (@SaaSletter) March 7, 2023

or this one by Rusil Sarka that might have raised early warnings for any celebration included with the bank:

When there is uncommon outflow of deposits, the bank requires to offer their properties to satisfy the withdrawals that is when bonds requires to be marked-to-market.

Exact same occurred to Silicon Valley Bank in 2021, when rates were low. It took $91 billion of that cash and invested it in home loan— Rusil (@rusilsarkar) March 6, 2023

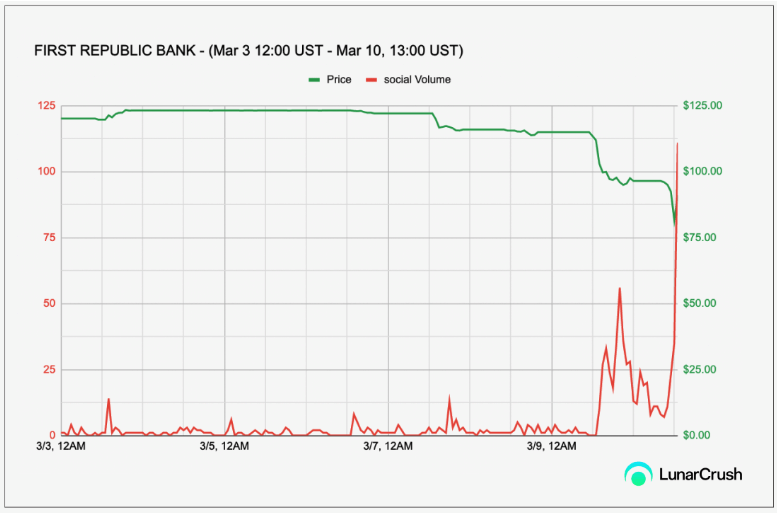

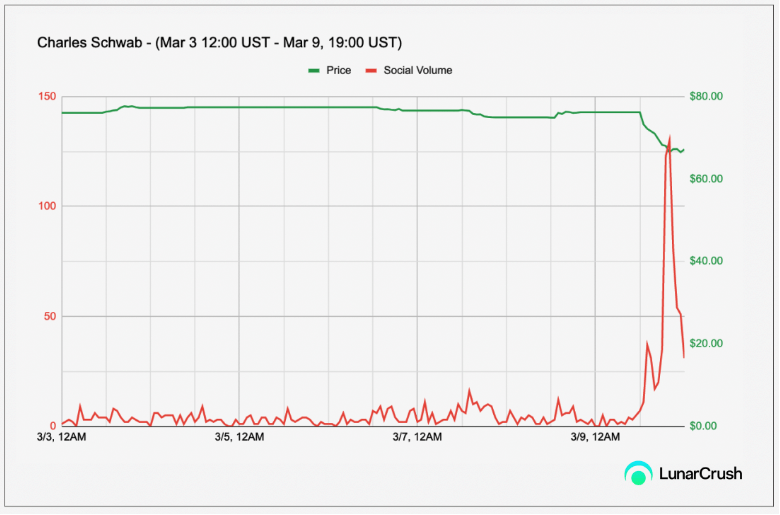

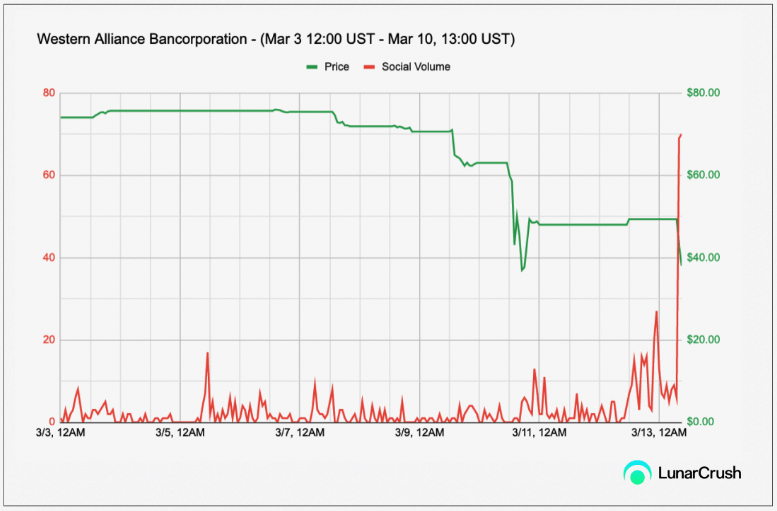

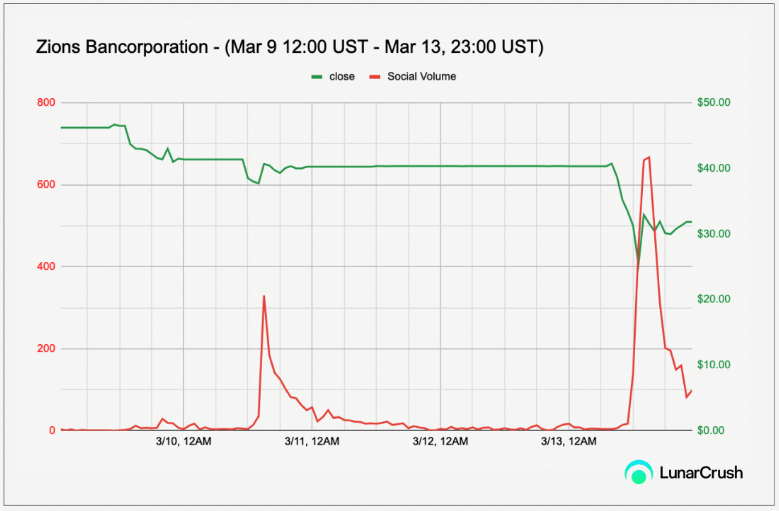

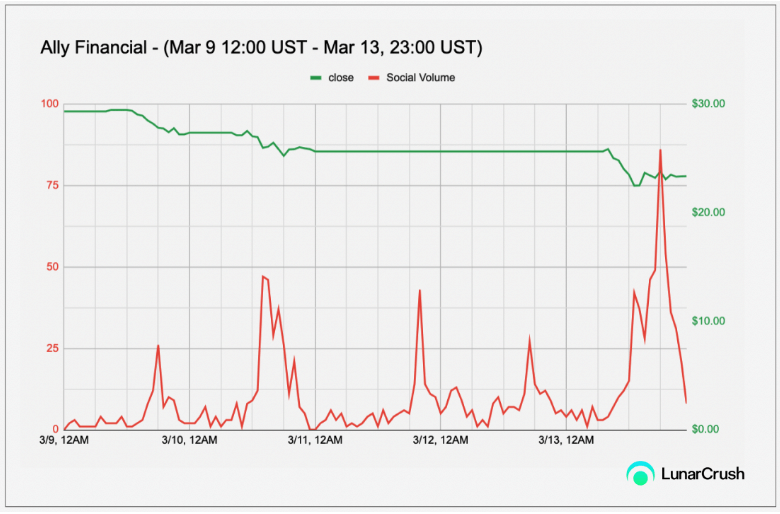

Comparable patterns can be discovered with the stocks of local banks impacted by the fallout of $SIVB, particularly banks like First Republic, Western Alliance, Comerica, Zions, and PacWest– who experienced as much as 65% drawdowns in a day. All of these big drawdowns were preceded by parabolic increases or abrupt upticks in social volume, showing the speed and conviction of social networks contagion:

Social network Is A Real Financial Risk

Keeping an eye on for outsized or unusual boosts in social chatter can assist capture early whiffs of peaceful (however quickly to be not peaceful) advancements. These big variances in social activity typically bring with them self-fulfilling bits of alpha. By recording mass attention and stimulating action in a brief amount of time– a video game logical dynamic is typically produced where the very first individual to act typically has the most to acquire (or the least to lose) and makes action or involvement more appealing for the subsequent celebration.

“Social media has actually sped up the spread of monetary info, and with it, the capacity for market contagions. Banks require to acknowledge and handle ‘social networks threat’ as part of their general danger structures. Tools like Moonrise by LunarCrush can assist keep an eye on and track early indication, making it possible for banks to form stories and engage with consumers better,” stated Joe Vezzani, CEO of LunarCrush.

Something is clear the dust decides on a rough week in the banking sector. Banks require to fulfill consumers where they are and handle stories and crises rapidly in their favored medium. An excellent interaction method might have assisted stem the fallout, however the secret would have been initially to capture these stories early in their advancement. By utilizing smart aggregation tools and keeping a strong, transparent social networks existence, market individuals can ideally be quicker and much better prepared to respond and handle these crises in the future.

The information here is thanks to the LunarCrush APIa social networks tracking engine that supplies access to precise, high-latency information on over 4000+ crypto possessions, 300+ NFT collections, and 700 stocks.

Author(s):

Toby Fan, Web3 Strategist Twitter|LinkedIn:

Toby Fan, Web3 Strategist Twitter|LinkedIn:

Toby Fan is the Head Web3 Strategist at LunarCrush, which supplies aggregated real-time social networks information on crypto, NFT, and conventional equities. He is a graduate of UC Santa Cruz, where he double learnt Econometrics and Information Systems and assisted lead department research study on product market characteristics in China and the United States. Toby is likewise an active factor for CoinMonks (https://medium.com/@tobyornottobyand a member of the BlockBros DAO. Aly Madhavji, Managing Partner at Blockchain Founders Fund and LP at Loyal VC & & Draper Goren Holm Twitter|LinkedIn

Aly Madhavji, Managing Partner at Blockchain Founders Fund and LP at Loyal VC & & Draper Goren Holm Twitter|LinkedIn

Aly Madhavji is the Managing Partner at Blockchain Founders Fundwhich buys, and endeavor constructs top-tier start-ups. He is a Limited Partner on Loyal VC and Draper Goren Holm. Aly speaks with companies on emerging innovations, such as INSEAD and the UN, on services to assist ease hardship. He is a Senior Blockchain Fellow at INSEAD and was acknowledged as a “Blockchain 100” Global Leader by Lattice80.

Disclosure: Blockchain Founders Fund is an early-stage financier in LunarCrush. None of the details here is implied to be interpreted as monetary suggestions.

Newest SVB Stories

Analysis: How social networks eliminated Silicon Valley Bank posted first on https://www.twoler.com/

No comments:

Post a Comment